When many people think of New York City, they think of Wall Street. Images of busy trading floors, the ringing of Closing Bells, and iconic status at the feet of massive financial institutions are inseparable from the identity of the Empire State. New York is a true global financial hub, with opportunities for every flavor of business and enterprise on the planet.

Space is also big business in New York, with Wall Street financing a key foundation on which the 21st Century American Space Age has been built. Regardless of the type of financing vehicle or the stage of development, New York is at the top of the US space finance rankings.

Empire Space is focused on understanding the dynamics of this critically important sector, including its interactions (or lack thereof) with other key space sectors across New York. This report will provide an overview of the Space Finance sector in New York along with analysis of major trends, takeaways, and lessons for the future.

Overview

Here are the major data points concerning the New York Space Finance sector:

> 18% of US space investors are located in New York, #2 in the nation. This includes:

- 39% of US Private Equity investors in space (#1).

- 18% of US Venture Capital investors in space (#2).

- 13% of US Angel investors in space (#2).

> 8% of Global space investors are located in New York.

> US space start-ups received over $15 billion in investment in 2021, double the previous record of $7 billion set in 2020.

Empire Space tracks 44 financial companies active in New York with a High level of space involvement, with a combined total Assets Under Management of $9.5 trillion (2021). An additional 74 sources are classified as having a Moderate level of space involvement. Combined with the High involvement category, these 118 institutions have $26.7 trillion AUM (2021).

The sheer size and depth of the New York Space Finance sector is apparent in these numbers, with over 100 active institutions and trillions of dollars in AUM, The dominance shows up in the nationwide rankings, with New York standing at or very near the top in every category of space investment.

Analysis

Empire Space analyzes the finance sector in two distinction groups: Business Capital and Business Services. Business Capital is composed of organizations and institutions that provide direct financing to space companies. Business Services is composed of organizations and institutions that provide support, resources, and other non-direct financial tools to space companies.

Much of the data in this report is sourced from Bryce Tech as they provide unmatched high-quality data about the global space ecosystem. We encourage our readers to explore the full range of insightful reports they offer.

Digging into the topline numbers reveals more detail about the breadth and depth of the NY space finance sector.

Business Capital

Business Capital is the heart and soul of the financial sector, generating the financial resources for space companies to grow and thrive. Empire Space tracks 34 Business Capital institutions in our database with a High level of space involvement, which will be the focus of this analysis.

Looking at Organization Type, a few conclusions jump out. First is the diversity of the sector, with 7 types of organizations highly active in space finance ranging from Angel Investors to Boutique Banks and Private Equity. Second is the dominance of Venture Capital, which composes fully half of the High space involvement category.

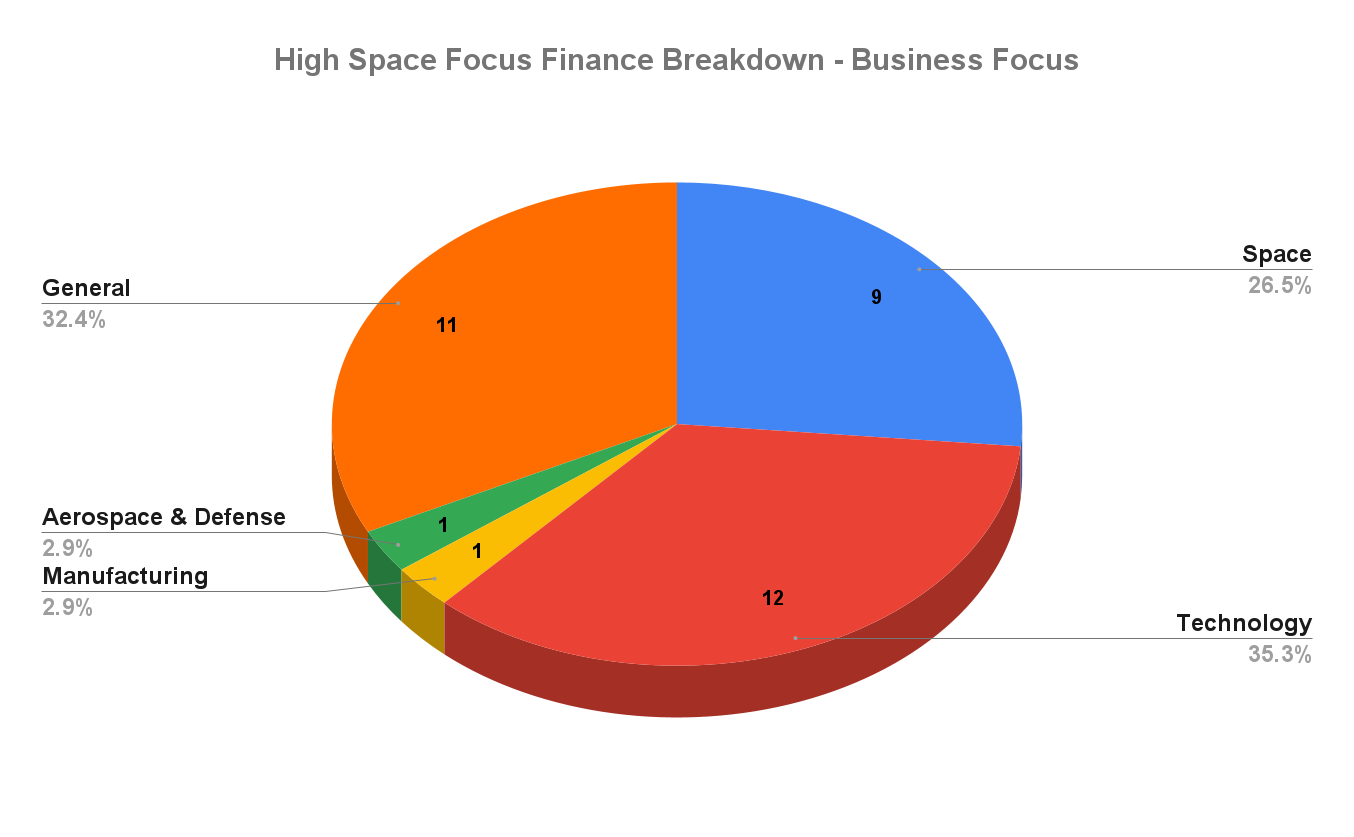

A look at the Business Focus of these 34 companies reveals even more diversity, with investment priorities ranging from Core Space to Technology, Manufacturing, and Aerospace & Defense. This diversity of focus is critical, demonstrating support for not just Core Space opportunities, but the broader aerospace industry and the secondary fields that support and amplify the Core Space sector.

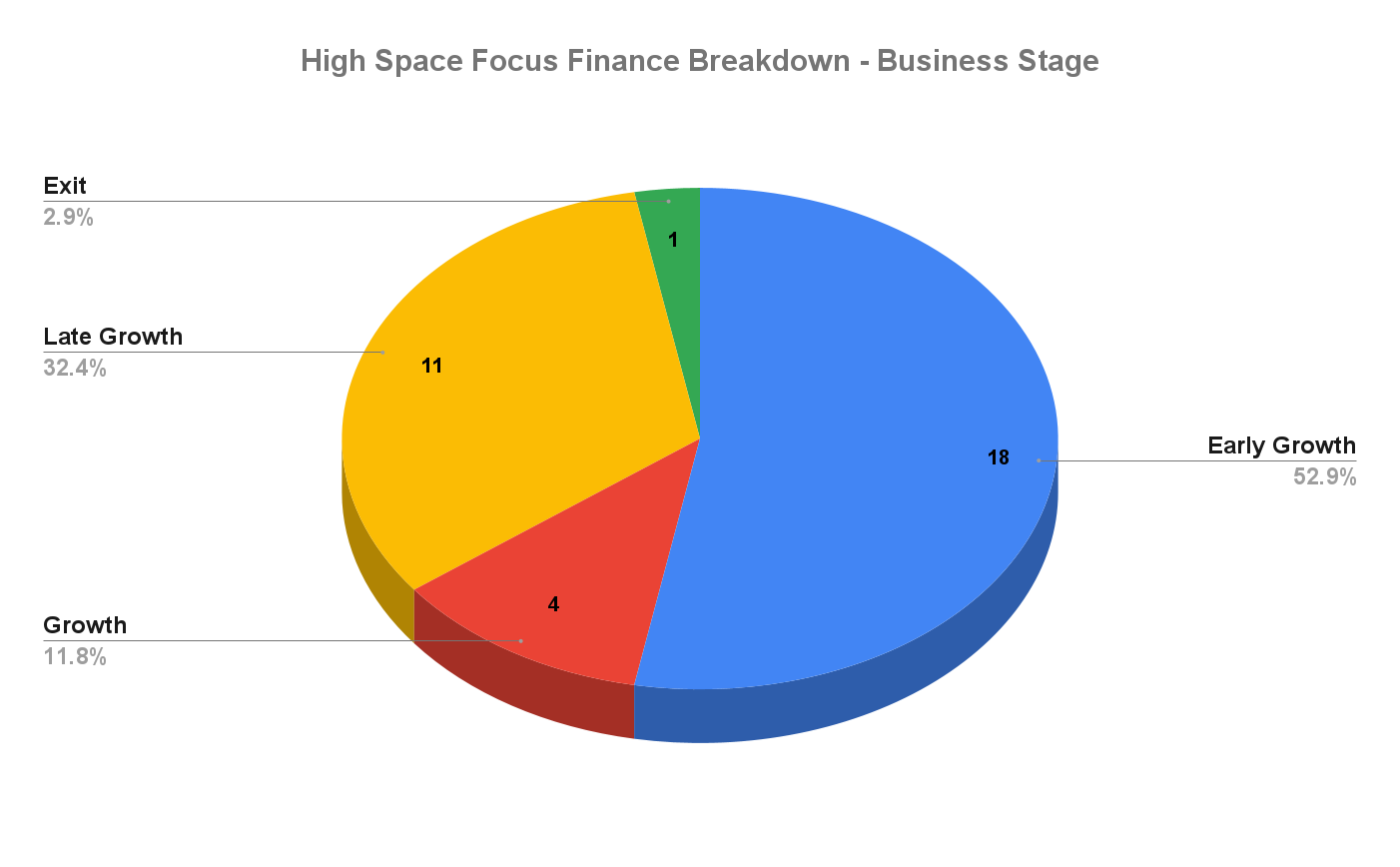

A breakdown by Investment Stage again reveals broad diversity, with all four stages of the business growth cycle represented in the High space involvement sector. It is clear however that Early Growth and Late Growth stage companies receive that vast majority of attention.

It is clear that New York is home to a broad and diverse array of Business Capital financial firms that are investing heavily all across the American space ecosystem. With over $9 trillion in AUM this powerhouse sector is a key component of the New York space ecosystem and a key potential engine for growth.

It is important to note that all 34 of these entries are located in New York City proper, and all but 1 are located in Manhattan.

Business Services

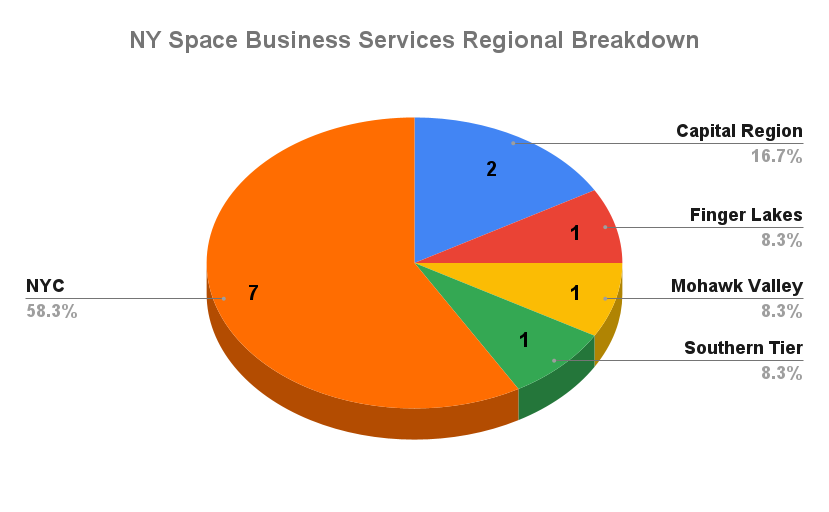

Business Services includes space business services from startup incubators, startup accelerators, startup communities, and broad service providers in all regions of New York State. Activity is focused in New York City, which contains most of the high- and moderate-space-focus business service providers. The next most active regions are the Capital Region, Western NY, and the Finger Lakes, while the least active regions are the North Country, the Mohawk Valley, and Long Island.

The Empire Space Census has 12 Business Service firms with a High Space Focus, which will be the focus of this analysis.

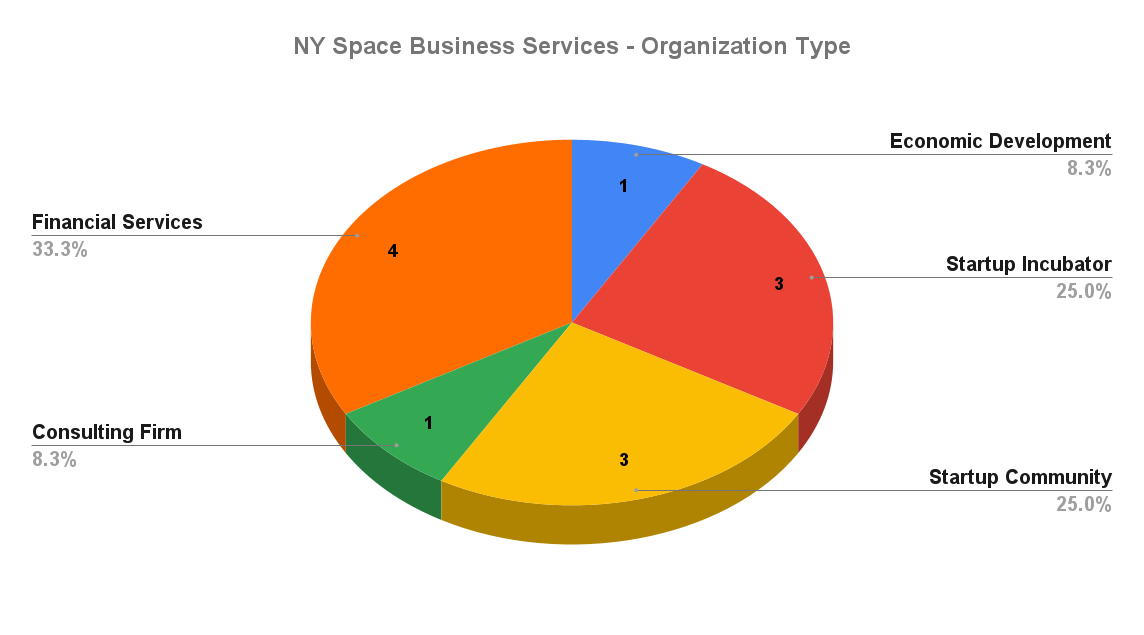

A breakdown by Organization Type reveals a level of diversity similar to that found in the Business Capital analysis. Financial Services, Startup Incubators, and Startup Communities are the major concentrations.

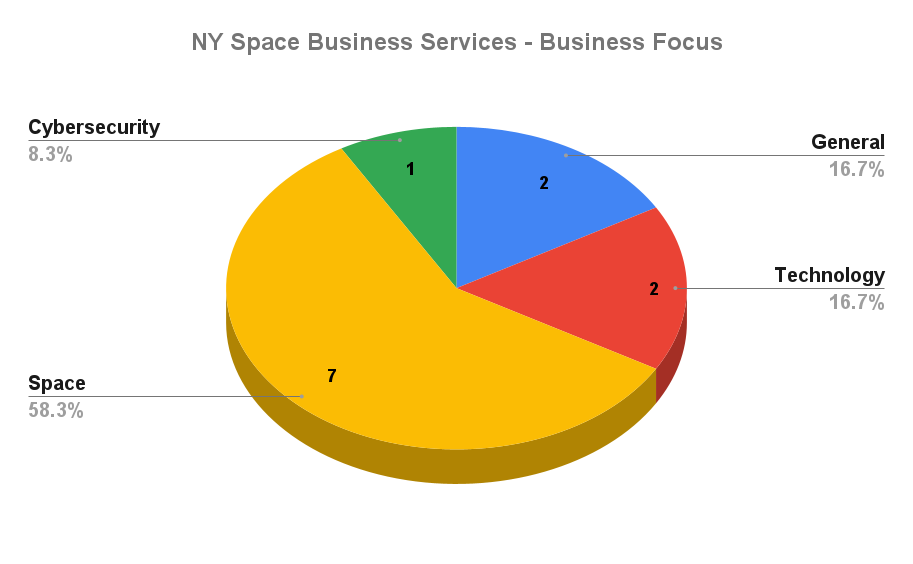

The breakdown by Business Focus reveals a strong focus on Core Space activities, with other areas including Technology and Cybersecurity.

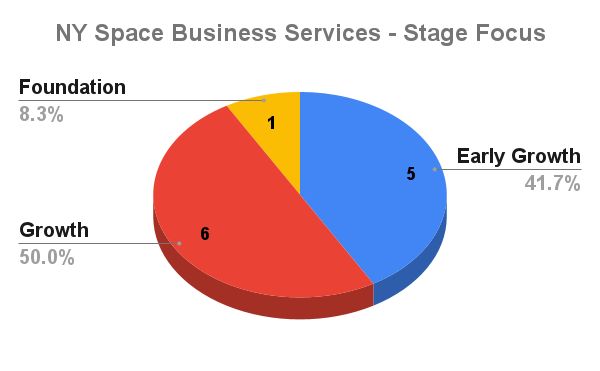

When looking at the Stage Focus of these 12 firms, it’s clear that Early Growth and Growth stages are the dominant focus for the sector.

A regional breakdown shows a level of diversity within New York that was lacking in the Business Capital sector. NYC still dominates, but there is a considerable presence in the Capital Region as well as the Finger Lakes, the Mohawk Valley, and the Southern Tier.

The New York Space Business Services sector is diverse in composition, focus, and location. These High Space Focus firms are a critical link in the broader space finance ecosystem, providing support and resources to the firms that fuel the 21st Century Space Age.

Conclusion

This concentration of space financing is a truly unique and powerful asset for New York’s space ecosystem as the state looks to position itself to grow our space sector in the 21st century. Regardless of the type of business, the stage of growth they invest in, or the type of company they support, New York has a space finance company at work.